This is unlikely to be good news for the housing market

/Home mortgage rates hit 20-year high of 6.9%, with many lenders charging well above 7%

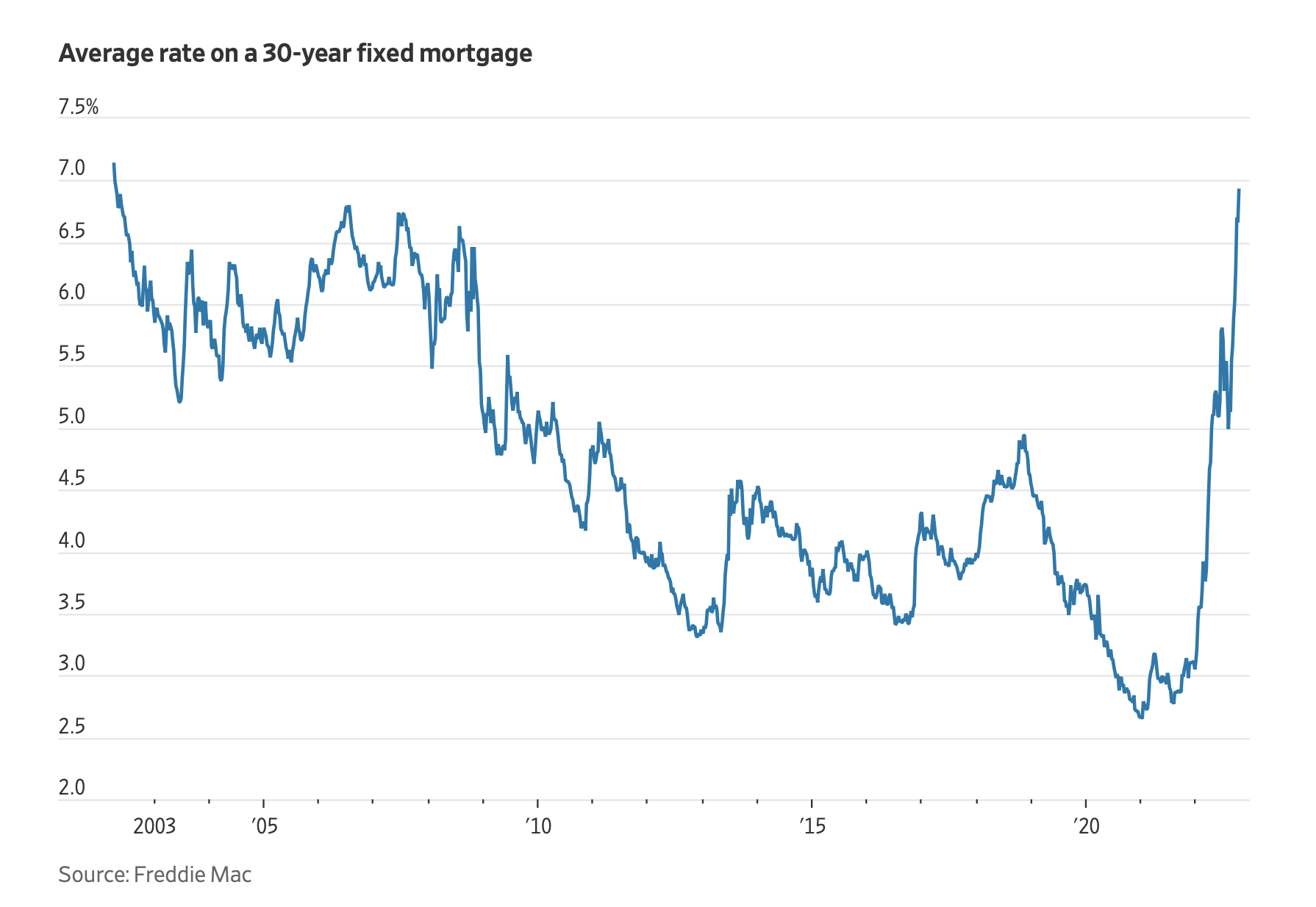

U.S. mortgage rates jumped to their highest level in more than two decades.

The average 30-year fixed mortgage rate hit 6.92% this week, according to a survey of lenders released Thursday by mortgage giant Freddie Mac. Many lenders are offering rates well over 7%. A year ago, the average rate was 3.05%.

The most recent jump, from 6.66% a week ago, took the rate above the peak of the last financial crisis. The benchmark has climbed nearly 2 percentage points since August, adding to an already brisk rise since the Federal Reserve began lifting rates earlier this year.

The latest climb has been particularly painful for the housing market, putting homeownership out of reach for many would-be buyers because of the added monthly cost of paying a mortgage at a higher rate.

Pal Nancy’s and my first mortgage in 1981 was 14.5%, and that was a discounted rate because the lender was a client of the law firm I’d joined, so 7% doesn’t sound all that horrible. But I doubt today’s buyer is terribly interested in what I was paying 40 years ago, and 7% vs last year’s 3% does seem daunting.

Pity the homeowner with a variable rate loan due to reset in the next couple of years, and as for housing inventory, how many homeowners with a fixed mortgage of, say, 2.5% will be interested in selling up and buying something new at 7%? Fewer than before, I’d guess.