More homeowners are staying put, so inventory stays low and prices stay high, for now. Oh! And mortgage rates are heading for 10%

/“Guess I shoulda bought last year — or maybe not”

Or that’s what these articles claim, and at least the first two don’t sound implausible, or even overly histrionic to me, while the third strikes me as not at all impossible. But they’re written by the same NY Post reporter, so we’re getting a single viewpoint, and you may want to keep the salt cellar handy. That said, I’ve seen similar reports from other sources.

Housing demand has cratered as mortgage rates ensure recession, analysts warn

October 24, 2022 12:52pm Updated

Demand within the US housing market has effectively “cratered” as mortgage rates surged to their highest level in decades, Raymond James analysts warned in a recent note to clients.

Prospective homebuyers are backing out of the housing market as long-term mortgage rates approach 7% and “ensure” a housing recession, the analysts said.

Homes will become even less affordable as mortgage rates continue to rise in response to the Federal Reserve’s sharp interest rate hikes.

“Numerous anecdotes and indicators (including this week’s NAHB Homebuilder Sentiment Index) corroborate that the recent parabolic spike in rates has cratered what residual housing demand was still in the market this summer,” analysts Buck Horne and Tousley Hyde said in an Oct. 21 note to clients.

“Moreover, with inflation indicators still stubbornly high and Fed governors intimating additional rate hikes to come, we cannot predict when/if credit spreads will begin to normalize,” they added.

The median US household would spend nearly 42% of its gross monthly income on mortgage payments at current levels – a huge figure that shattered the previous record of 40% in 2006 just before the housing market collapsed, according to the analysts.

Why mortgage rates could hit 10% by early 2023

October 20, 2022 12:43pm

Surging mortgage rates could hit double digits by next year even if the Federal Reserve backs off its aggressive interest rate hikes, a prominent expert warned.

Fed rate hikes have a “lag effect in mortgages,” Christopher Whalen, chairman of Whalen Global Advisors, said in an interview with MarketWatch published on Thursday. That means the full effect of tightened Fed policy isn’t felt in the housing market for weeks or months after each hike.

“Lenders only slowly adjust their rates,” Whalen told the outlet. “They are not used to seeing rates moving this fast, and typically would change rates only once a month or once every other month.”

The Fed has been sharply hiking its benchmark interest rate for months as it looks to cool the economy and tame decades-high inflation. While the Fed’s hikes don’t directly influence mortgages, rates tend to move higher as policy grows more restrictive — resulting in higher costs for prospective homebuyers.

Whalen said mortgage rates could “easily touch 10% by February” even if Fed Chair Jerome Powell and other policymakers signal a pause in interest rate hikes at the central bank’s last meeting of the year in December.

This third article is a little more alarmist, but we’ve certainly seen a 20% drop before, and a long recovery: I refer the reader to 2008, through 2020.

Home prices could fall 20 percent next year as mortgage rates hammer the market.

October 20, 2022 12:43pm Updated

US home prices could plunge as much as 20% within the next year as soaring mortgage rates bring the housing market to a standstill, a prominent economist said Thursday.

Existing-home sales declined for the eighth consecutive month in September, falling 1.5% month-over-month to an adjusted annual rate of 4.71 million, according to the National Association of Realtors. The slump is the longest since 2007. Sales are down nearly 24% compared to one year ago.

With mortgage rates surging toward 7%, there is still “no floor in sight” for declining home sales, according to Ian Shepherdson, chief economist at Pantheon Macroeconomics. Shepherdson expects home prices to fall by 15% to 20% over the next year due to cratering demand.

“If you’re planning to move homes and will need a new mortgage, you will face a huge increase in rates,” Shepherdson said in a note to clients. “It’s entirely possible that even people who want to trade down will face a bigger monthly payment; that’s a good reason to stay put, thereby constraining supply.”

“But prices have to fall substantially in order to restore equilibrium; the supply curve for housing is not flat, so the plunge in demand will drive prices down,” he added.”

Here’s another article from a different source, citing Redfin, and saying just about the same thing:

Redfin Corp. shares sank to their lowest level on record Wednesday, after the residential real-estate brokerage reported a sharp drop in September home sales and listings that suggests a housing-market “standstill” in which prices budged only slightly even as higher mortgage rates crimp demand.

The number of homes sold last month fell 25% year-over-year, and new listings fell 22%, Redfin disclosed. Those were the biggest decreases on record with the exception of the early months of the pandemic, Redfin said.

“The U.S. housing market is at another standstill, but the driving forces are completely different from those that triggered the standstill at the start of the pandemic,” Redfin economics research lead Chen Zhao said in a statement.

Decreasing sales and listings would suggest a decline in demand and therefore prices, but that was not the case. Median home-sale prices slipped 0.5% month-over-month in September, but they were still up 8% year-over-year at $403,797.

“This time, demand is slumping due to surging mortgage rates, but prices are being propped up by inflation and a drop in the number of people putting their homes up for sale,” Zhao said. “Many Americans are staying put because they already relocated and scored a rock-bottom mortgage rate during the pandemic, so they have little incentive to move today.”

For more: When will house prices drop? These economists say prepare for a ‘prolonged slowdown’

Redfin said roughly 60,000 deals were called off last month, or around 17% of homes that went under contract during the month. That’s the highest share on record aside from March 2020, the company said.

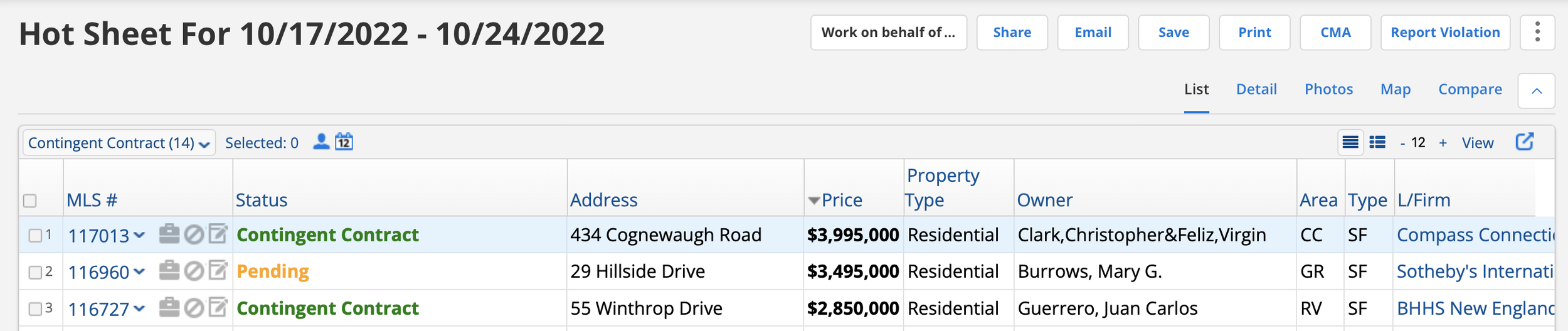

The Greenwich market is still not dead, and in fact, there have been 7 contracts signed for houses priced above $5 million since September 1, most, but not all of which had been on the market for hundreds of days. That said, here are all of the single family residences that went to contract in the past week:

(And one late addendum, Spring house road, $995,000.)