No man's wife, liberty, or cattle are safe when the legislature is in session

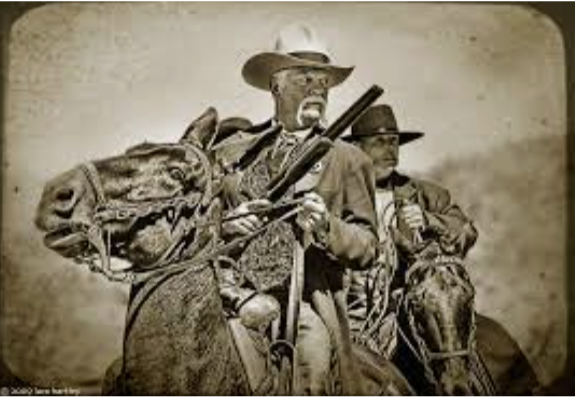

/Off to Hartford, Boys

That’s been cleaned up to “liberty, life, or property”, but I’ve always enjoyed the original Texas version. But no matter, hold onto your cattle, because the Connecticut looters are back in Hartford, and boy do they have plans for you

To ensure that any tax relief offered this year [to The Little People] is sustainable — and to recession-proof core services and programs — progressive Democratic legislators on the Finance Committee have proposed raising taxes on the wealthiest households.

The panel voted Wednesday to hold a public hearing on Looney’s proposal for statewide property tax on homes with assessed values at $1.2 million or greater.

And since property tax assessments represent 70 percent of market value, this involves homes priced at more than $1.7 million.

This mansion tax could generate as much as $86 million. Looney says the revenue should be used to fund the school desegregation initiatives the state recently endorsed to settle the landmark Sheff v. O’Neill case and also to relieve local school districts of surging special education costs.

The Finance Committee also will hold a hearing on a plan from Looney for a 1 percent income tax surcharge on the capital gains earnings on the state’s wealthiest households. This involves couples earning more than $1 million annually and singles topping $500,000. It would raise about $130 million per year.

Although I’ve long since lost the source, some years ago I looked up the number of state employees added to the payroll since Weiker and his pals put in an income tax. While the population didn’t increase — it’s around 3.7 million, I believe — the number of state workers went up something like 400%. Just sayin’.

But the news isn’t all bad, because the legislators have a bonus for most of you:

To combat rising gasoline prices, the committee will hold a public hearing this spring on a bill proposed by Senate President Pro Tem Martin M. Looney, D-New Haven, to credit all working households, regardless of their income limits, with $50.

Spend it wisely.