All is proceeding according to plan: Massive Texas oil refinery to close permanently

/say goodbye to all this

First the refineries go out, then the lights, and we’ll be back to the days of paradise. This has been the long-term goal of the anti-humans since at least the mid-60s, and t

A key Texas petroleum refinery that produces more than 200,000 barrels of fuel per day is facing a premature shutdown that could increase pressure on domestic fuel supplies.

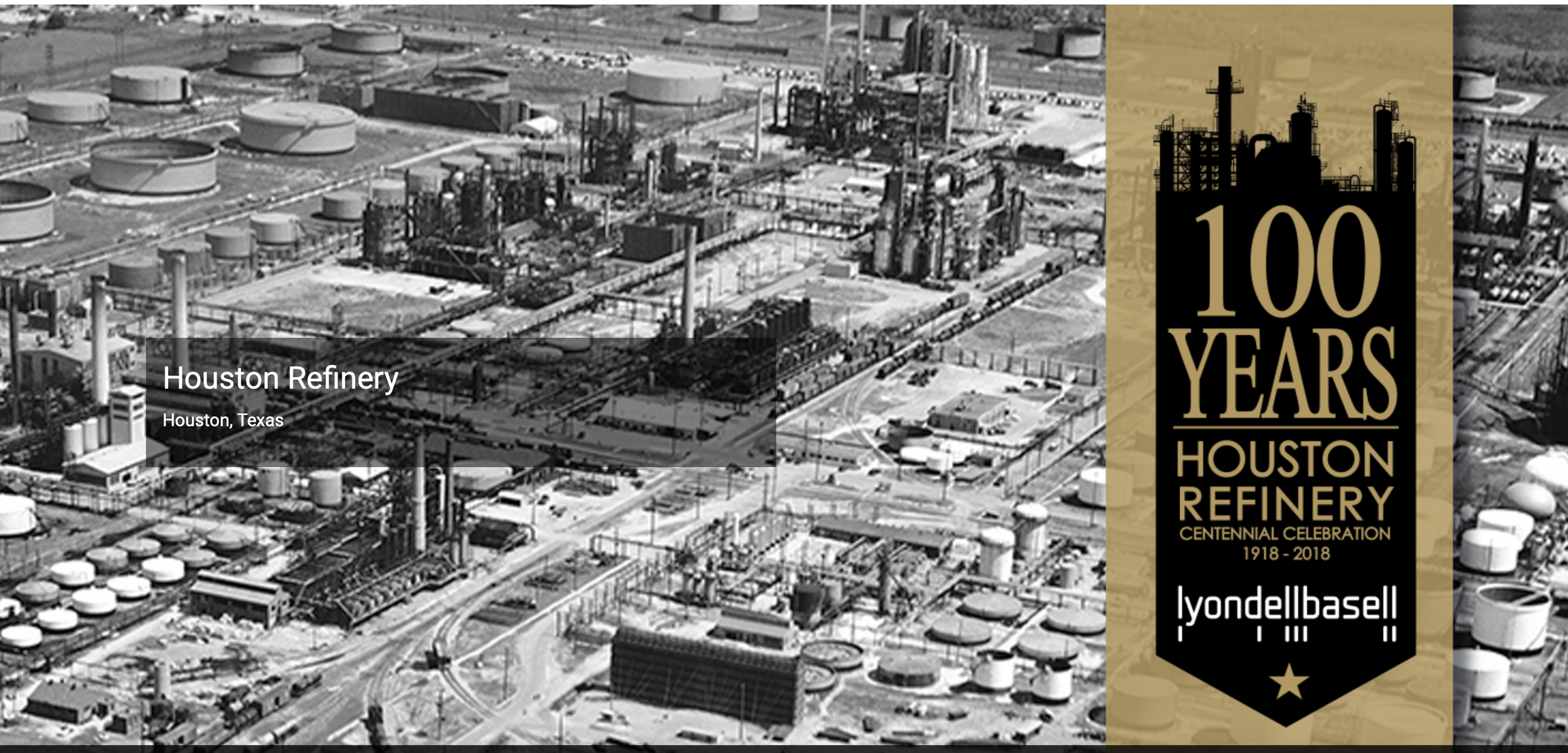

The Houston, Texas, facility — which is operated by LyondellBasell Industries, spans 700 acres and was built in 1918 — is scheduled to permanently close by the end of 2023, but could shut down earlier if a “major equipment failure” spreads to major units, two people familiar with the issues told Reuters. The refinery processes 268,000 barrels per day (bpd) of oil and produces 92,600 bpd of diesel fuel, 89,000 bpd of gasoline and 44,500 bpd of jet fuel.

There hasn’t been a new refinery built since the 1970s, and Chevron’s CEO doesn’t believe there will ever be another.

Chevron CEO Mike Wirth says he does not expect another oil refinery to be built in the U.S. ever again, pointing to decades of federal government policies as the reason why.

"There hasn’t been a refinery built in this country since the 1970s," Wirth said at Bernstein's Strategic Decisions Conference this week, when asked about the prospect of new capacity being added in the Gulf of Mexico. "I personally don’t believe there will be a new petroleum refinery ever built in this country again."

"Capacity is added by de-bottlenecking existing units by investing in existing refineries," he explained. "But what we’ve seen over the last two years are shutdowns. We’ve seen refineries closed. We’ve seen units come down. We’ve seen refineries being repurposed to become bio refineries. And we live in a world where the policy, the stated policy of the U.S. government is to reduce demand for the products that refiners produce."

Wirth went on to list examples such as the Corporate Average Fuel Economy (CAFE) standards for fuel efficiency in vehicles that Congress first enacted in the 70s, the Renewable Fuel Standard created in 2005 requiring a certain amount of biofuels like Ethanol to replace petroleum-based fuels, and electric vehicle tax subsidies.

"At every level of the system, the policy of our government is to reduce demand, and so it’s very hard in a business where investments have a payout period of a decade or more," Wirth said. "And the stated policy of the government for a long time has been to reduce demand for your products."

To put things in perspective, Wirth asked rhetorically, "How do you go to your board, how do you go to your shareholders and say 'we're going to spend billions of dollars on new capacity in a market that is, you know, the policy is taking you in the other direction."

The U.S. hasn’t constructed a major petroleum refinery since 1977 even as fuel demand and domestic oil production have surged in recent decades.

Major refinery operators have largely opted to upgrade facilities rather than construct new greenfield plants because of the projected fuel demand decline in coming years and lengthy regulatory process required for such projects, according to industry experts. There have been 14 small refineries, each processing 4,100-46,250 barrels of oil a day, constructed since Marathon Oil opened its 200,000-barrel-per-day facility in Garyville, Louisiana, in 1977.

“The COVID pandemic really drove down gasoline and diesel demand which accelerated some things that were already happening,” Geoff Moody, the vice president of government relations at the American Fuel & Petrochemical Manufacturers (AFPM), told The Daily Caller News Foundation in an interview.

“There was already some contraction happening in the industry as a result of projected declines in U.S. gasoline demand into the future and companies just deciding that the assets were better used as other projects or shut down completely,” Moody continued. “Some of its been very policy-driven and companies decided that it wasn’t worth it to keep operating those assets.”

The U.S. and other western nations have accelerated plans for a global green transition away from fossil fuels even as prices have skyrocketed to record levelsthis year. AFPM and other industry groups have urged the Biden administration to focus on long-term solutions, like boosting domestic oil production and shoring up refining capacity, amid the current energy crisis.

Global refining, which is vital for producing fuels like gasoline and diesel, decreased by 1.4 million barrels a day between 2019 and the first quarter of 2022, according to the International Energy Agency. Most of the refinery closures occurred in western countries, the data showed.

In the U.S., refineries processing a total of more than 800,000 barrels a day have closed since 2019 leaving the nation with a total operating refinery capacity of 17.7 million barrels a day, its lowest level since 2013. In addition, there are five idle U.S. refineries — the highest number since 2012 — which have a total capacity of 408,000 barrels a day, an issue the White House is reportedly considering addressing.

“Some refineries just shut down because of lack of demand, and they’re not coming back on,” Hugh Daigle, a professor of petroleum engineering at the University of Texas at Austin, told Minnesota Public Radio.

Moody, from the AFPM, added that companies have chosen to grow the footprint and throughput of existing refineries rather than make risky investments in new facilities. Refinery capacity has grown by about 3.3 million barrels per day as the number of refineries has fallen from 199 to 124 since 1985.

Dan Kish, a senior fellow at the Institute for Energy Research, blamed the decreased refinery capacity and lack of new greenfield projects on the growing number of environmental regulations and required permits.

“We’ve gone from many smaller refineries to refineries operating more efficiently and more economically,” Kish told TheDCNF in an interview. “Just like everything else, it’s very difficult to build anything or to keep anything operating in the United States where we have the strictest environmental laws in the world.”

“They keep squeezing emissions through Clean Air Act, through [the National Environmental Policy Act],” he continued. “They just throw lots of red tape at these folks and it makes it harder and harder to stay afloat.”

Since 2000, the Environmental Protection Agency (EPA) has entered into 37 settlements covering 112 refineries across 32 states with companies that control more than 95% of total U.S. refining capacity, according to a database of EPA enforcement actions. In March, Chevron Phillips Chemical Company agreed to make facility upgrades worth $118 million and pay a $3.4 million penalty over alleged Clean Air Act violations.

Meanwhile, a refinery being built in North Dakota, the largest greenfield refinery since the 1977 Marathon plant, began its permitting process in 2013 and isn’t expected to be completed until 2023, Forbes reported in 2020.