Luxury home market blues

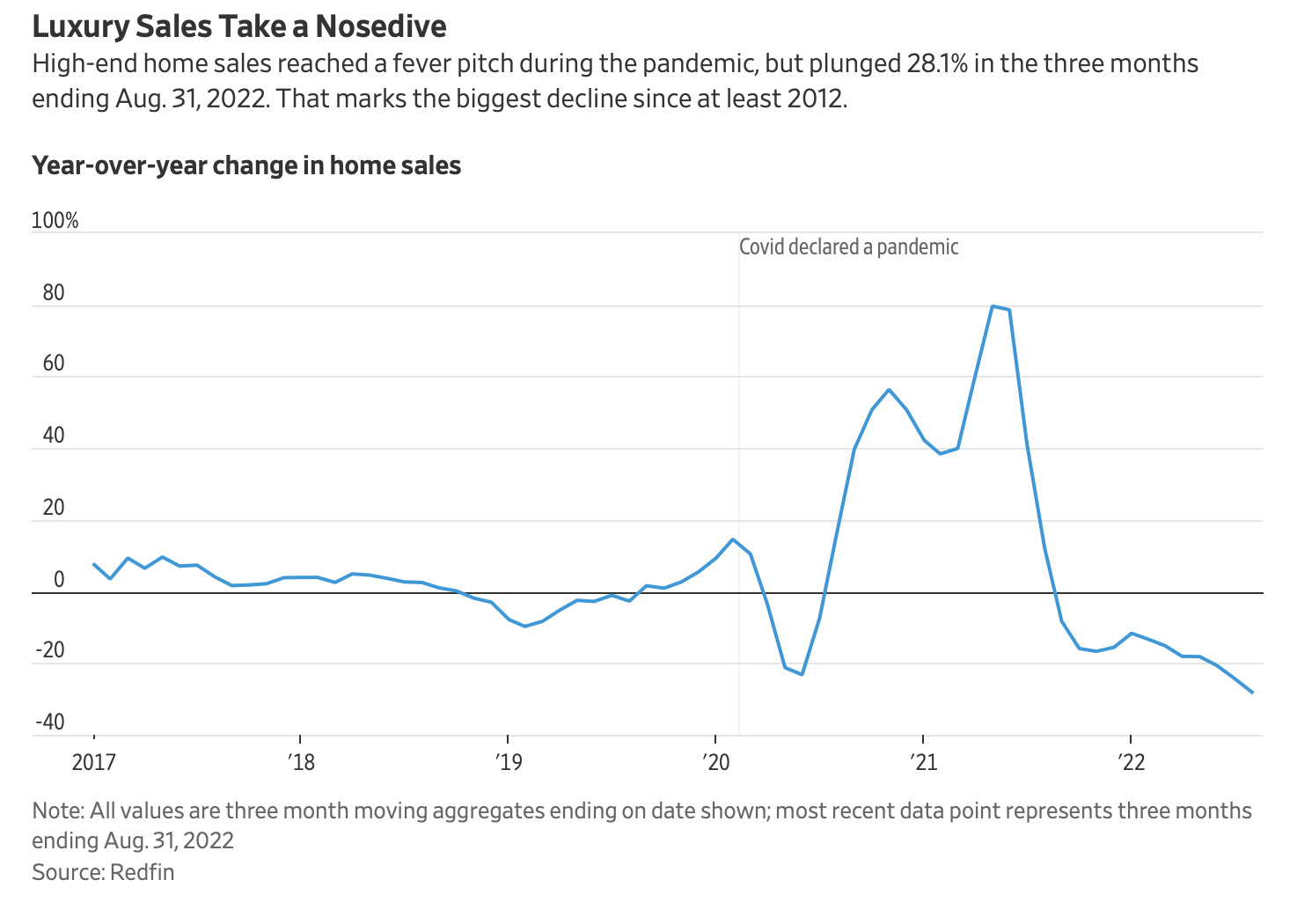

/[Slow sales] are becoming increasingly common as the luxury housing market cools following its pandemic-induced bull run. A new report by real-estate brokerage Redfin shows that in the three months ending Aug. 31, sales of luxury U.S. homes dropped 28.1%, from the same period last year. That marks the biggest decline since at least 2012, when Redfin’s records began, and eclipses even the 23.2% decrease recorded during the onslaught of the pandemic in 2020, the report said.

Sales of nonluxury homes also fell during the same period, but that drop—19.5%– was smaller than the decline in the luxury market, which is defined as the top 5% of homes based on estimated market value, according to Redfin.

“Six months ago, people were buying homes over-ask and with no appraisal,” said Ms. Lam’s real-estate agent, Herman Chan of Golden Gate Sotheby’s International Realty. “They didn’t even bat an eyelash. Now, it’s like crickets.”

High-end California markets have seen some of the steepest declines in sales volume, Redfin’s data shows. The number of home sales plunged by close to 64% in Oakland, Calif., while San Jose and San Diego also posted decreases of more than 55%. The number of home sales fell 44.3% in Los Angeles, 55.5% in Miami and 11.8% in New York.

Major reasons for the slowdown include recession fears and rising interest rates, which have priced some buyers out of the market and spooked others, according to Redfin Chief Economist Daryl Fairweather. Buyers are getting “sticker shock” when they see the impact of rising rates, which is causing them to re-examine their finances and their buying power, she said. And while superwealthy buyers often aren’t directly impacted by interest rates—many purchase in cash—Ms. Fairweather said they are still paying attention to wider economic indicators.

“We’re dealing with inflation, and inflation cuts into profits,” she said. “Rich people definitely care about how much profits the companies they are invested in are making. That affects stock prices, it affects treasury yields.”

As for purchasing real estate in all cash, Treasurys seem like a better bet than real estate right now, Ms. Fairweather said. “No investor wants to put their money into an asset that is going down in value,” she said.

BUT:

Mr. Chan said he believes the slowdown in activity is more severe in the luxury market because high-end homeowners have a greater degree of discretion about when to sell and at what price. Often, sellers face no financial pressure to move, he said; they can just wait it out.

Scott Lennard, an agent with Compass in the Seattle, Wash., area, who is listing a $12.5 million estate on Lake Washington, said his client is willing to hold out for the right price and is in no rush to sell, though the property has been on the market for about eight months.

While the volume of luxury sales across the country has dipped dramatically, prices are still holding firm, though their growth has slowed. The median sale price of a U.S. luxury home grew 10.5% to $1.1 million during the three months ending Aug. 31, according to Redfin, compared with a 20.3% increase during the same period of last year. Ms. Fairweather said she expects prices to decline throughout the winter.

Meanwhile, many buyers no longer feel urgency to move quickly, because houses are sitting on the market longer, Mr. Chan said. Some of his clients also dropped their budgets amid stock market volatility this summer, he said. One couple was originally shopping for a home in the $5 million range, but reduced their budget to around $4 million after some of their stocks took a battering and interest rates rose, he said. “They basically lost their down payment buffer zone,” he said.

But, however, comma …

The shortage of luxury inventory that helped drive prices at the start of the pandemic is easing, Redfin’s data shows. The number of luxury homes for sale nationwide is up 39.2% from a record low of roughly 121,000 earlier this year.

Many sellers, however, haven’t adjusted to the new realities of the market, Mr. Chan said. Some of his buyers have made lowball offers on homes, only to be met with significant resistance. “It’s a stalemate,” he said. “Sellers are living in the past, the buyers are living in the future.”

And there’s this to considerA different article in the Journal today has this to say:

… [H] ome prices are sticky on the downside: Unless their circumstances demand it, many homeowners simply won’t sell if their ask isn’t met. Inflation can, of course, reduce the real value of a home but, according to data compiled by Yale’s Robert Shiller (the Nobel Prize-winning economist who with the late Karl Case constructed the Case-Shiller indexes), the only time since the Great Depression U.S. home prices (unadjusted for inflation) have fallen significantly on a national basis was during the housing bust.

So there you have it: clear as mud, with the outlook depending entirely on your expectation of what’s coming at us. I’m of the looming disaster school. Wall Streeters seem to be more optimistic, but the trading ranks seem to be made up of those proverbial 27-year-olds who know literally nothing, especially history, and are swayed by whatever liberal cant they hear on CNN, so I, personally don’t care what they’re “thinking” except perhaps to bet against them.

If 2008 repeats, and I think it will, there will be some good buying opportunities in the next couple of years as stubborn homeowners gradually give up on their aspirational prices and drop them down, say, 25%, or even more. My clients and I had some vey successful house hunts in the 2008-2016 years, finding the most overpriced homes and lobbing lowball bids at them. The longer the luxury housing market recession dragged on, the more often these bids were accepted. But not always: in fact, 90% of the initial bids were rejected, usually silently and politely, but sometimes furiously. If we circled back a year later, though, we often met a different reception (and there’s noting more satisfying than receiving a call from an agent who the year before had dismissed your earlier bid as “insulting”, inquiring whether my client “was still interested?”

So what do I know? Just about nothing, and potential buyers in the end of the market are far more financially sophisticated than I, and they can make up their own minds. Then again, I never bought a single share of Beyond Meat.