While the DOJ focuses on crushing and prosecuting pro-life ladies and unauthorized tourists in the Capitol, the swamp denizens are thriving.

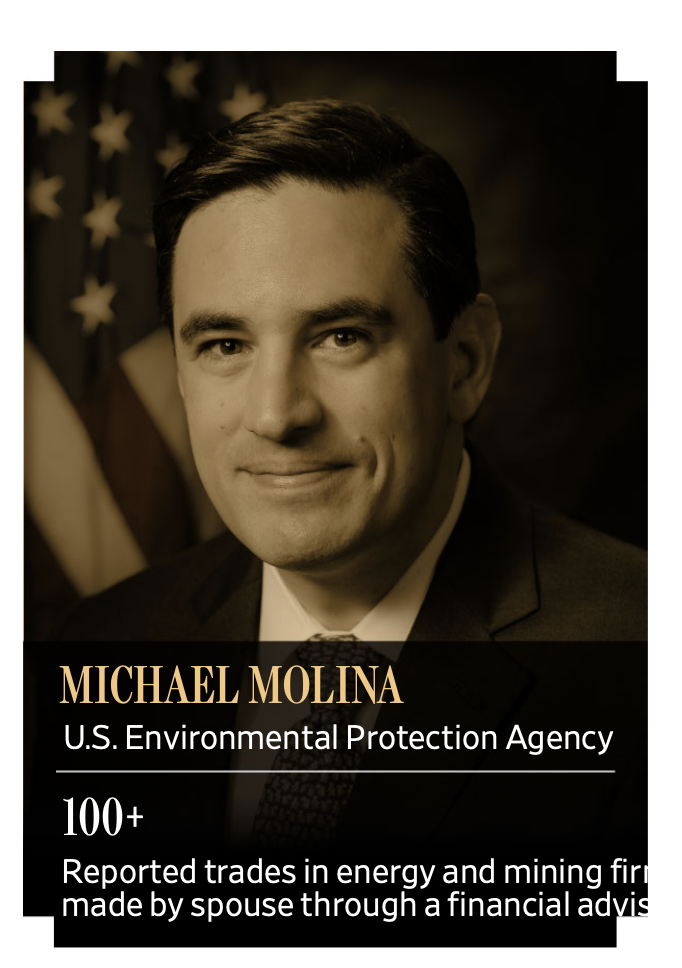

/“I feel that I am being targeted and have been asked to report more than anyone else,” he wrote in a Nov. 3, 2020, email. (Mr. Molina’s husband also traded the same stocks.)

Thousands of officials across the government’s executive branch reported owning or trading stocks that stood to rise or fall with decisions their agencies made, a Wall Street Journal investigation has found.

More than 2,600 officials at agencies from the Commerce Department to the Treasury Department, during both Republican and Democratic administrations, disclosed stock investments in companies while those same companies were lobbying their agencies for favorable policies. That amounts to more than one in five senior federal employees across 50 federal agencies reviewed by the Journal.

A top official at the Environmental Protection Agency reported purchases of oil and gas stocks. The Food and Drug Administration improperly let an official own dozens of food and drug stocks on its no-buy list. A Defense Department official bought stock in a defense company five times before it won new business from the Pentagon.

The Journal obtained and analyzed more than 31,000 financial-disclosure forms for about 12,000 senior career employees, political staff and presidential appointees. The review spans 2016 through 2021 and includes data on about 850,000 financial assets and more than 315,000 trades reported in stocks, bonds and funds by the officials, their spouses or dependent children.

The vast majority of the disclosure forms aren’t available online or readily accessible. The review amounts to the most comprehensive analysis of investments held by executive-branch officials, who have wide but largely unseen influence over public policy.

AMONG THE JOURNAL’S FINDINGS:

• While the government was ramping up scrutiny of big technology companies, more than 1,800 federal officials reported owning or trading at least one of four major tech stocks: Meta Platforms Inc.’s Facebook, Alphabet Inc.’s Google, Apple Inc. and Amazon.com Inc.

• More than five dozen officials at five agencies, including the Federal Trade Commission and the Justice Department, reported trading stock in companies shortly before their departments announced enforcement actions, such as charges and settlements, against those companies.

• More than 200 senior EPA officials, nearly one in three, reported investments in companies that were lobbying the agency. EPA employees and their family members collectively owned between $400,000 and nearly $2 million in shares of oil and gas companies on average each year between 2016 and 2021.

• At the Defense Department, officials in the office of the secretary reported collectively owning between $1.2 million and $3.4 million of stock in aerospace and defense companies on average each year examined by the Journal. Some held stock in Chinese companies while the U.S. was considering blacklisting the companies.

• About 70 federal officials reported using riskier financial techniques such as short selling and options trading, with some individual trades valued at between $5 million and $25 million. In all, the forms revealed more than 90,000 trades of stocks during the six-year period reviewed.

• When financial holdings caused a conflict, the agencies sometimes simply waived the rules. In most instances identified by the Journal, ethics officials certified that the employees had complied with the rules, which have several exemptions that allow officials to hold stock that conflicts with their agency’s work.

Federal agency officials, many of them unknown to the public, wield “immense power and influence over things that impact the day-to-day lives of everyday Americans, such as public health and food safety, diplomatic relations and regulating trade,” said Don Fox, an ethics lawyer and former general counsel at the U.S. agency that oversees conflict-of-interest rules.

He said many of the examples in the Journal analysis “clearly violate the spirit behind the law, which is to maintain the public’s confidence in the integrity of the government.”

Some federal officials use investment advisers who direct their stock trading, but such trades still can create conflicts under the law. “The buck stops with the official,” said Kathleen Clark, a law professor and former ethics lawyer for the Washington, D.C., government. “It’s the official who could benefit or be harmed…. That can occur regardless of who made the trade.”

Read the whole damn thing if your blood pressure’s running too low today, but watch out: the details are sickening, and this is only the first in a series of articles the Journal has ready to go.