National real estate trends aren't necessarily local, and this particular company's woes may not even be a trend but ....

/guests, like dead real estate firms, begin to stink after three days

Redfin lays off 8% of workers, forecasts years of fewer home sales amid rate hikes

Demand for homes fell nearly 20% short of May projections

Redfin CEO Glenn Kelman announced the firings in a public post to the company's website on Tuesday, saying real estate demand in May fell nearly 20% short of expectations.

"To all the departing people who put your faith in Redfin, I’m sorry we can’t keep our commitment to you," Kelman wrote. "With May demand 17% below expectations, we don’t have enough work for our agents and support staff, and fewer sales leaves us with less money for headquarters projects."

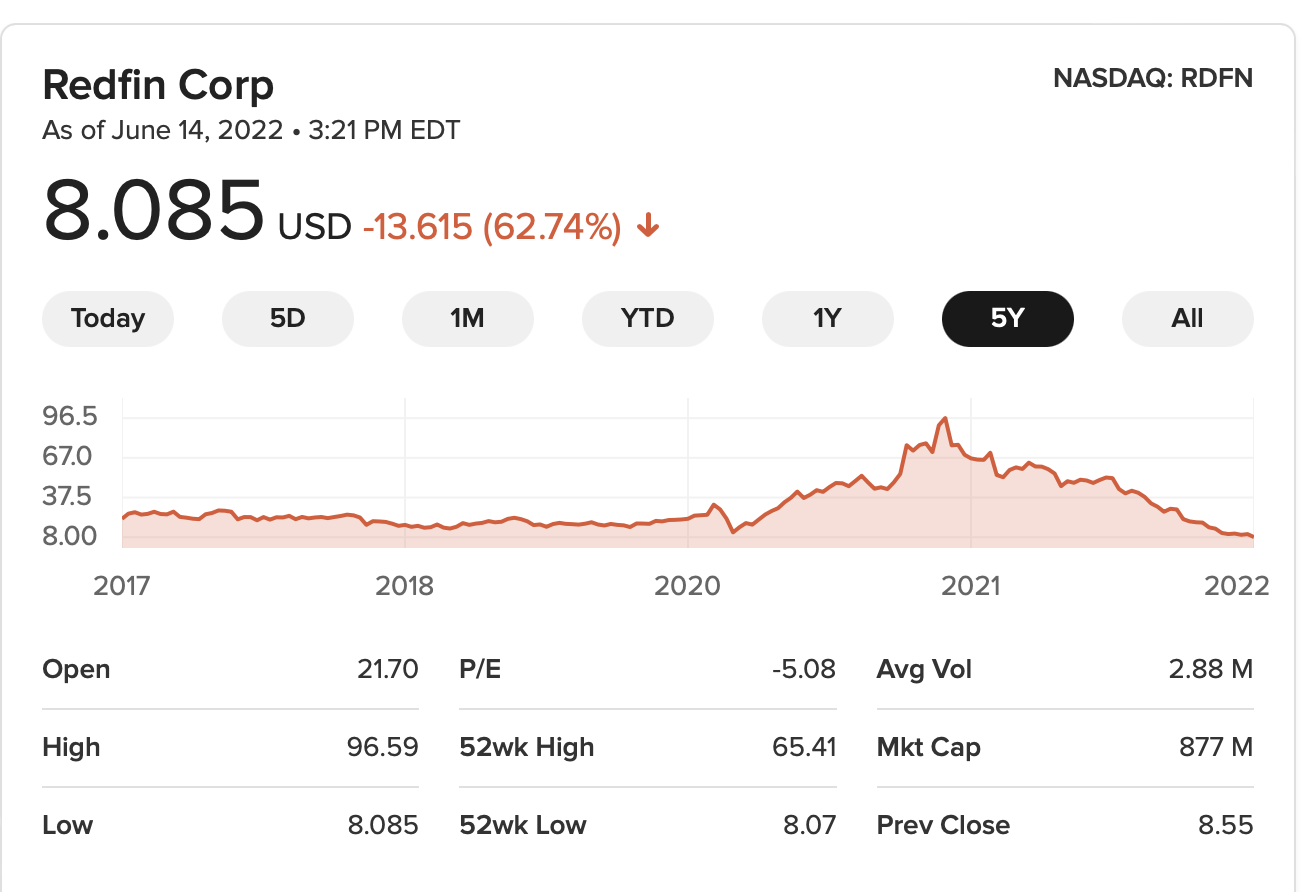

"Mortgage rates increased faster than at any point in history," he added. "We could be facing years, not months, of fewer home sales, and Redfin still plans to thrive. If falling from $97 per share to $8 doesn’t put a company through heck, I don’t know what does."

Simply Reverting to norm?

And there’s this, from the not particularly accurate Motley Fool — make of it what you will.

Monday morning before market open, Redfin disseminated the findings of a homebuyer budget analysis produced by its researchers. The findings were sobering: In the three months ending April 30, the average such budget barely inched up, rising a weak 0.3% on a year-over-year basis. That was the lowest growth rate since June 2020, according to the real estate company's findings.

Redfin pointed out, sensibly, that a drop in home-buying budgets decline indicates that housing price growth has peaked and will soon fall.

As if that wasn't discouraging enough, the report comes one trading day after Redfin divulged the findings of a proprietary study on U.S. luxury home sales that was even more concerning.

The company said that such sales suffered a nearly 18% year-over-year drop in the same three-month stretch covered by the homebuyer budget analysis. This was a much sharper fall than the 5.4% of the non-luxury category, and is the steepest rate since the start of the coronavirus pandemic.